![]()

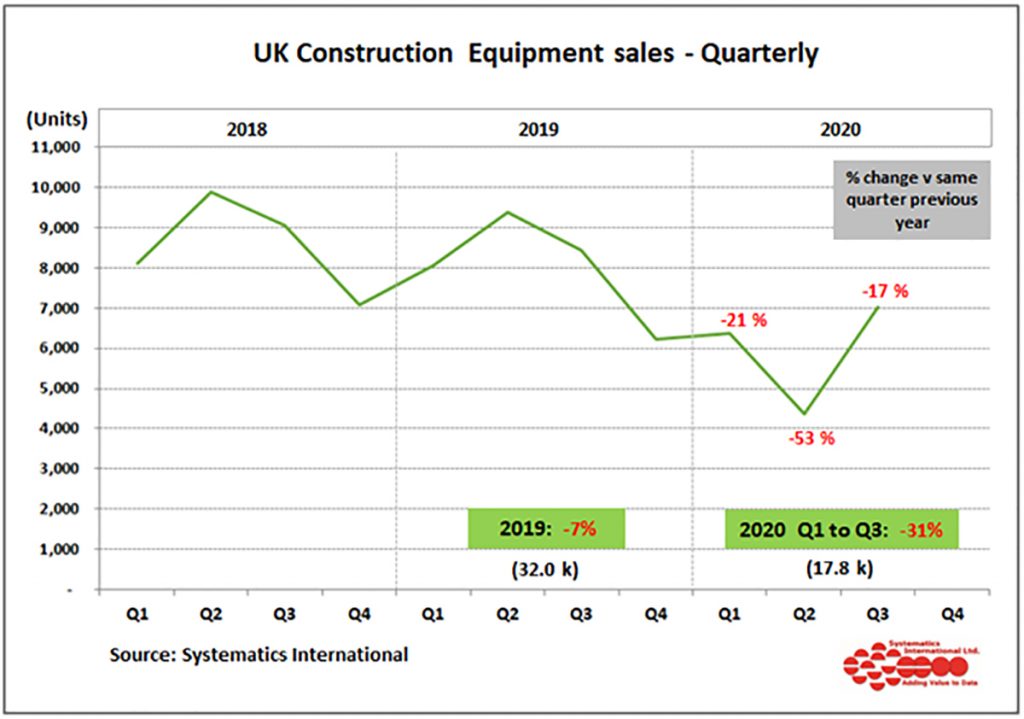

Retail sales of construction and earthmoving equipment were 17% lower in Q3 this year compared with the same quarter in 2019. This takes sales in the first three quarters of the year to 31% below last year’s level during the same time period. This is an improvement on the position at the end of the previous quarter, when sales were 38% below 2019 levels at mid-year.

Strong sales in September have helped to reduce the deficit compared with 2019. At over 2,600 units in September, they were only 7% below 2019 levels and can be considered the first month to see sales return to near normal levels since February, before Covid-19 hit. Sales in previous months since May have been on an improving trend, but were still showing double digit shortfalls compared with sales in the same month in 2019. The expectation now is that equipment sales for the full year might be in the range of 25% to 30% below last year’s levels, if modest recovery continues in Q4, which is traditionally the quietest quarter of the year.

The second chart below provides an update on the ranking of sales for the major equipment types, showing the size of the decline in the first three quarters of the year compared with the same period in 2019. This shows a similar pattern to previous months with the most popular equipment type, mini and midi excavators (up to 10 tonnes), continuing to see stronger demand than all of the other equipment types. Sales of mini/midi excavators in Q3 were 7% above 2019 levels, and reduced the shortfall in year to date sales to only 13% below 2019. Strong demand from the house building market is reported to be supporting sales for these smaller machines. Sales of many of the other major equipment types are still over 40% lower than 2019 levels on a year to date basis.

The construction equipment statistics exchange also covers retail sales of equipment in the Republic of Ireland. In Q3 sales matched 2019 levels, and have reduced the shortfall in the first three quarters of the year to 19% below last year’s levels.

*The construction equipment statistics exchange is run by Systematics International Ltd. This scheme is run in partnership with the Construction Equipment Association (CEA), the UK trade association.