![]()

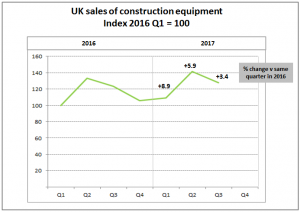

In the first three quarters of 2017, sales of construction and earthmoving equipment grew by 6% compared with the same period in 2016. Sales in the July/September quarter grew by over 3%, but represent a slowing pattern of growth from the first quarter, when sales were up by nearly 9% compared with 2016. Equipment sales in the UK market have shown a distinctive seasonal pattern in the last few years, “peaking” in Q2, and then “bottoming” in Q4. (The graph below illustrates sales on an index basis using Q1 2016 as 100).

Growth in equipment sales in 2017 has been driven by crawler excavator sales which are more than 13% higher than 2016 in the first nine months of the year. This includes mini excavator sales, which are the most popular product in the UK, and reflect a strong house building market this year. Overall confidence within the equipment supply chain has remained positive, particularly within the rental sector. For example, in the Q3 European Rental Association survey, a 60% majority in the UK expect market conditions to be “better” in the next 12 months (compared with the “same” or “worse”). This is significant for the UK equipment market, where the rental sector is estimated to account for over 60% of market supply. Overall, equipment sales within the UK market have been relatively strong since 2014, with levels of sales in the last 3 years at their highest since the market crash in 2008.

In 2017, the construction equipment statistics exchange has been taken over by Systematics International Ltd., a specialist data processing company. The scheme is run in partnership with the Construction Equipment Association (CEA), the UK trade association.